28% for trustees or for personal representatives of someone who has died for disposals of residential property. 20% for trustees or for personal representatives of someone who has died (not including residential property). 18% and 28% tax rates for individuals for residential property and carried interest. 10% and 20% tax rates for individuals (not including residential property and carried interest). The following Capital Gains Tax rates apply: The Capital Gains Tax rate you use depends on the total amount of your taxable income, so work that out first. To find out more read Residence, domicile and the remittance basis: RDR1, and contact HMRC if you have any questions. Issues of domicile and tax on foreign gains are complicated. You may have claimed the remittance basis if you have income and gains from abroad and have decided that it’s beneficial to be taxed on the foreign income and gains that you bring into the UK, rather than on all income and gains that arise. You may be non-domiciled in the UK if you were born in another country and intend to return there, for example. You will not get the annual exempt amount if you’re non-domiciled in the UK and you’ve claimed the remittance basis of taxation on your foreign income and gains. If you’re acting as a trustee for a disabled person use the ‘Individuals, personal representatives and trustees for disabled people’ rates shown in the annual exempt amount table.įor Capital Gains Tax purposes, a disabled person is a person who has mental health problems, or gets the middle or higher rate of Attendance Allowance or Disability Living Allowance.įind out more about Capital Gains Tax and trusts. After that there’s no tax-free allowance against gains during the administration period.įind out more about dealing with the estate of someone who’s died. This means one annual exempt amount against gains in each of those years. You’re entitled to the annual exempt amount for the tax year in which the death occurred and the following 2 tax years. The administration period is the time it takes to settle the deceased person’s affairs, from the day after the death until the date everything has been passed on to beneficiaries.

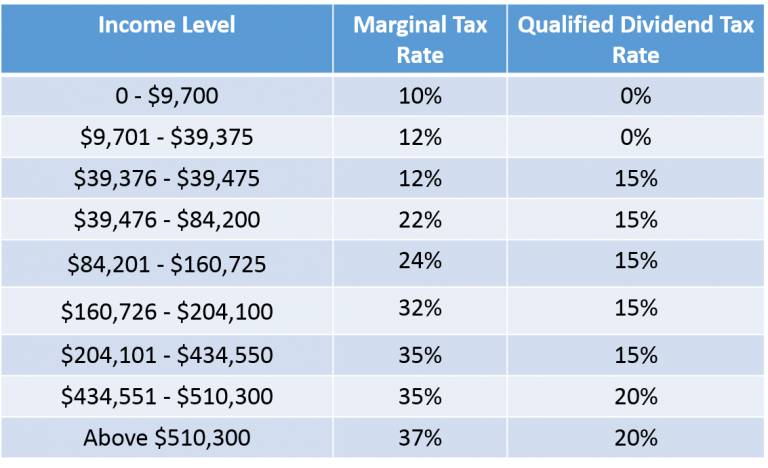

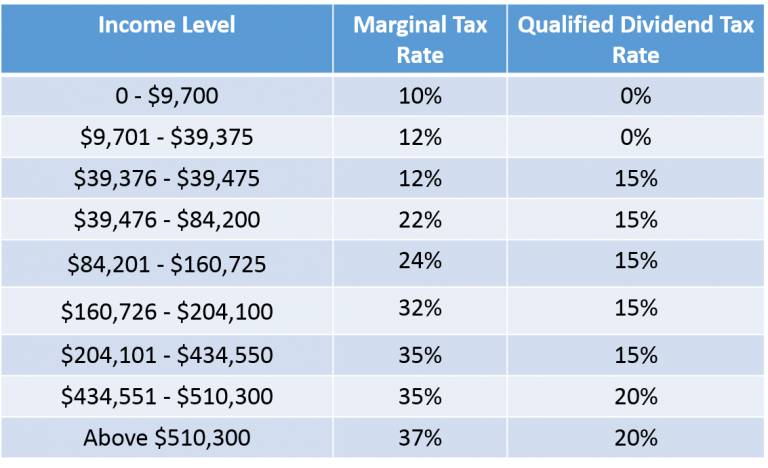

28% for trustees or for personal representatives of someone who has died for disposals of residential property. 20% for trustees or for personal representatives of someone who has died (not including residential property). 18% and 28% tax rates for individuals for residential property and carried interest. 10% and 20% tax rates for individuals (not including residential property and carried interest). The following Capital Gains Tax rates apply: The Capital Gains Tax rate you use depends on the total amount of your taxable income, so work that out first. To find out more read Residence, domicile and the remittance basis: RDR1, and contact HMRC if you have any questions. Issues of domicile and tax on foreign gains are complicated. You may have claimed the remittance basis if you have income and gains from abroad and have decided that it’s beneficial to be taxed on the foreign income and gains that you bring into the UK, rather than on all income and gains that arise. You may be non-domiciled in the UK if you were born in another country and intend to return there, for example. You will not get the annual exempt amount if you’re non-domiciled in the UK and you’ve claimed the remittance basis of taxation on your foreign income and gains. If you’re acting as a trustee for a disabled person use the ‘Individuals, personal representatives and trustees for disabled people’ rates shown in the annual exempt amount table.įor Capital Gains Tax purposes, a disabled person is a person who has mental health problems, or gets the middle or higher rate of Attendance Allowance or Disability Living Allowance.įind out more about Capital Gains Tax and trusts. After that there’s no tax-free allowance against gains during the administration period.įind out more about dealing with the estate of someone who’s died. This means one annual exempt amount against gains in each of those years. You’re entitled to the annual exempt amount for the tax year in which the death occurred and the following 2 tax years. The administration period is the time it takes to settle the deceased person’s affairs, from the day after the death until the date everything has been passed on to beneficiaries. 2018 INCOME AND CAPITAL GAINS TAX BRACKETS FULL

If you’re acting as an executor or personal representative for a deceased person’s estate, you may get the full annual exempt amount during the administration period. Tax yearĪnnual exempt amount for individuals, personal representatives and trustees for disabled people

You can use your annual exempt amount against the gains charged at the highest rates to reduce the amount of tax you owe.

This is not available to companies who dispose of a UK residential property, as they may be able to claim other allowances. executors or personal representatives of a deceased person’s estateĪ lower rate of annual exempt amount applies for most other trustees.įrom 2015 to 2016, non-residents who dispose of a UK residential property are liable to Capital Gains Tax and, in most cases, can claim the annual exempt amount in the same way as UK residents.You only pay Capital Gains Tax if your overall gains for the tax year (after deducting any losses and applying any reliefs) are above the annual exempt amount. You’ll get an annual tax-free allowance, known as the annual exempt amount ( AEA), if you’re liable to Capital Gains Tax every tax year unless you’re non-domiciled in the UK and have claimed the remittance basis of taxation on your foreign income and gains.

0 kommentar(er)

0 kommentar(er)